New railway line will run through communities including Arabian Ranches 2, Damac Hills and Town Square

Staff Reporter

Transport links are a vital component of choosing where to buy a property, especially in a growing city like Dubai.

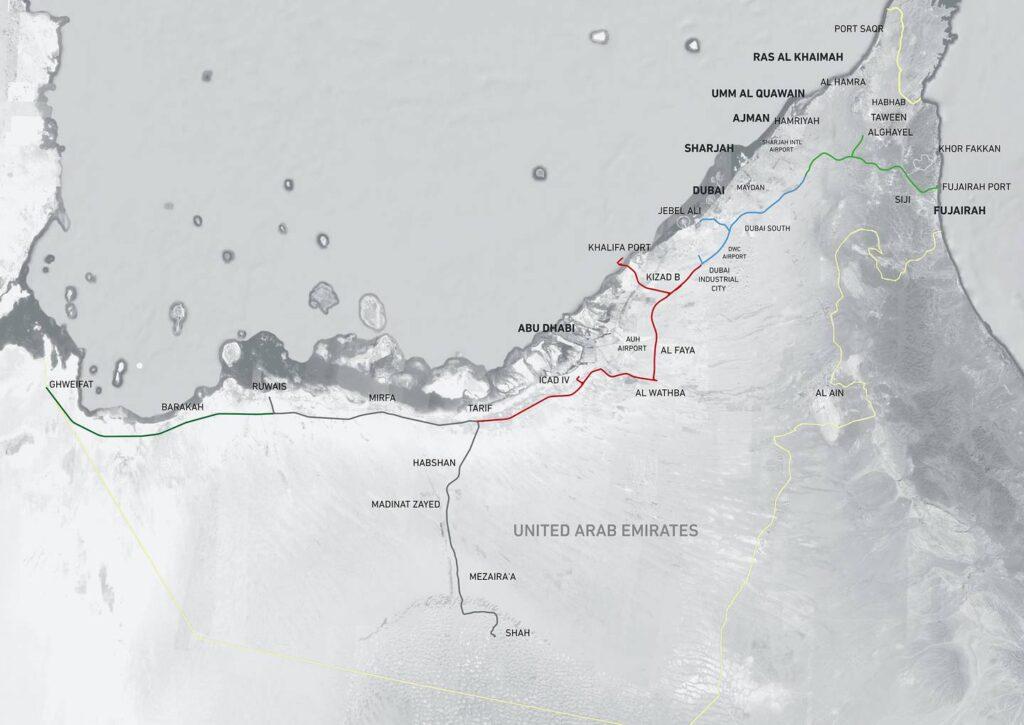

With the Dubai Metro covering part of the city, the emirate is also gearing up for passenger trains with the development of Etihad Rail.

A launch date for the railway’s passenger line between Dubai and Abu Dhabi has yet to be announced but, once ready, it is expected to have a major influence on where people live, work and study.

The line will pass through popular Dubai communities such as Al Furjan, Reem Mira, Arabian Ranches 2, Mudon, Damac Hills, Arabella, Town Square and Green Community East and West, and is expected to drive up prices in those areas.

“Transport links are always an advantage when looking to invest in property in any city — Dubai is no different,” says Lewis Allsopp, chief executive of Allsopp & Allsopp.

It is too early to get precise price predictions just yet given the wide spectrum of communities that are clustered around the rail line, Mark Richards, sales director at LuxuryProperty.com, tells The National.

to develop existing networks to improve passenger connections.

For residents at areas such as Jumeirah Golf Estates, the line would be more of a bonus than adding to the quality of life, while on the other hand, neighbourhoods such as Discovery Gardens and Dubai Investment Park would benefit tremendously from having a rail line, he says, adding: “that could be the factor that influences a home purchasing decision there”.

“While exact percentages are tricky to talk about, it goes without saying that a community in proximity to a railway station will command premium prices because of the high levels of convenience you get from that sort of positioning,” Mr Richards says.

“We aren’t going to see investors cashing in on those communities until later on, though. I would expect them to hang back for a bit and really assess the positive impact of the rail line as it gets going. There is tremendous investment potential here, but ultimately it is about getting the best return for your buck.”

Etihad Rail’s link between Dubai and Abu Dhabi stretches for more than 250 kilometres and includes 29 bridges, 60 crossings and 137 drainage channels.

It was announced in March that the tracks between the two emirates had joined up.

The travel time between Dubai and Abu Dhabi is expected to be about 50 minutes, with a journey from the UAE capital to Fujairah said to take twice that time.

“Having an inter-emirate railway will be a massive addition to the UAE and will contribute to the population migration, growth and further development of this country,” said Lynnette Sacchetto, director of data and digital Transformation at Allsopp & Allsopp.

“It will allow for residents to have the flexibility to live in one emirate and work in another which opens up many options which would not have existed before. The value and demand of property along the railway and within close proximity to the stations will also be positively affected and new developments in areas not yet developed but connected to the railway will now be viable options for developers and investors.”

The railway line is expected to carry more than 36 million people each year by 2030 between 11 cities in the seven emirates. Stations will stretch from Sila near the border with Saudi Arabia to Fujairah on the east coast.

New passenger services will operate at about 200 kilometres per hour.

“If you’re arriving at the airport, you will soon be able to hop on a train rather than having to go and rent a car to get to where you want,” Tamer Salama, managing director in the GCC of French rail-equipment maker Alstom, told The National last month.

“It is much more cost-effective for residents who commute as well, as they will be saving money they would otherwise spend on the likes of fuel and Salik gate fees.”

The addition of the rail network could further support the growth of the Dubai property market, which has rebounded strongly from the impact of the coronavirus pandemic on the back of government initiatives, such as residency permits for retirees and remote workers, as well as the expansion of the 10-year golden visa programme and the economic boost from Expo 2020 Dubai.

Property prices have been rising across Dubai amid record transactions in recent months.

Data from consultancy CBRE showed average villa prices had risen 20.4 per cent in the past year and 1.9 per cent month-on-month in April. Total volume of transactions in Dubai’s residential property market rose 43 per cent annually to 6,342 in April, the report said.

Some of the steepest price rises have been at the top end of the market. Dubai’s prime property sector has boomed in the past year, with prices rising almost 60 per cent in the past 12 months.

UAE megaprojects 2022: new developments in Dubai, Abu Dhabi and Northern Emirates

The 19 million square foot project will include 4,000 villas and townhouses in total. Construction is set to begin in the second quarter and the first homes

are scheduled to be handed over in the first quarter of 2023. Courtesy Arada

Comments are closed.