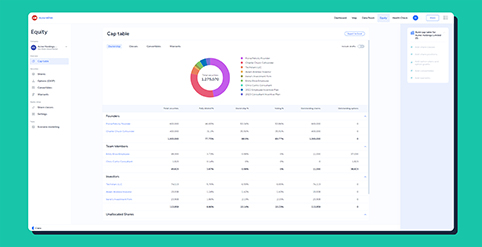

DUBAI: Clara — the legal operating system that provides digital tools to help founders form, manage and scale their start-ups — has launched a new cap table feature to address the pain points experienced by founders, investors and lawyers in trying to manage start-up equity.

If you’re asking what a ‘cap table’ is, it’s short for ‘capitalisation table’. You can think of a cap table as a ledger of a company’s ownership. Every share certificate, convertible investment agreement, option grant, exercise, or transfer is a transaction that updates the ledger. And every transaction should be verified by the stakeholders on the cap table (e.g., investors and team members) to confirm its accuracy.

Since inception, Clara has been steadily building out a suite of products designed to support the global start-up ecosystem. The new cap table feature – Clara’s biggest feature release yet – integrates with the other features they are well-known for, including digital company formations, ESOP creation, document generation and data room management. More than 5,000 start-ups around the world now use Clara to manage their legal operations.

“From a macro perspective, Clara is building the digital infrastructure that powers the start-up economy across emerging markets, including all the tooling founders need to form, manage and scale their companies. With the new cap table launch, we are positioned to support much more closely those investors, accelerators and law firms that work with start-ups. Historically, these stakeholders have had a challenging time helping founders with their cap tables. Clara’s new solution solves this problem for them.”

Founders making cap table tracking mistakes is an issue that venture capital firms know all too well. Shane Shin, Founding Partner at Shorooq Partners, one of the leading early-stage investment firms in the MENAP region, noted that most start-ups still track their cap tables manually in Excel, and that they typically contain errors. “The source of ‘truth’ for cap tables is held in the investment agreements and team member option grants. Unless the precise characteristics of the legal terms in those agreements are reflected accurately in the cap table, the output of the cap table model will be wrong. And this leads to major problems for start-ups, as well as investors and lawyers. We are thrilled to see Clara’s cap table solution come online – their timing could not be better.”

Christopher Rose agrees. He is a partner at Dentons, the world’s largest law firm, and advises both start-ups and venture investors across emerging markets on fundraising deals. “Cap table arguments between founders, investors and lawyers occur on almost every deal we do. These arguments typically result from the cap table not being properly tracked from the get-go. This ends up costing start-ups a lot more in legal fees, and also frequently a reduction in the shareholding percentages the founders thought they had in their companies.”

Clara’s cap table can be used to model and compare future fundraising scenarios, set up equity grants for employees and track their vesting schedules, and share equity positions with investors and team members, with Clara’s customer success team there to support companies every step of the way during onboarding. It’s also the first cap table solution in the world to be built on the Open Cap Table Format with international companies in mind.

Clara’s cap table is set to compete with major US cap table providers like Carta and Pulley. Carta was most recently valued at $7.5 billion and has captured a large share of the US digital cap table market. But Carta and their US competitors have been built for the needs of US companies, without much thought being given to the unique needs of international start-ups. And international founders often find these solutions challenging to use, not to mention incredibly expensive. By contrast, Clara’s cap table solution is free for early-stage companies who do not need its full complement of features immediately.

Start-ups are already starting to migrate their cap tables to Clara from competitors like Carta. Omar Rifai is a Co-founder of GrubTech, a foodtech start-up headquartered in the UAE with a presence in 18 international markets across Europe, the Middle East and Africa that has raised over $20 million. His company recently moved their cap table over to Clara and noted that “US cap table solutions aren’t tailored to the differentiated needs of international start-ups. Clara is the only cap table provider we found that had emerging market start-ups in mind. Add to that all the other things you can do on the Clara platform, from building your ESOP to data room management, and switching was a no brainer.”