Relationship managers, compliance and risk officers, and those with experience in digital banking are much sought-after, recruitment experts say

Staff Reporter

The hiring outlook for the UAE’s banking and financial services industry is buoyant as it continues to recover from Covid-19 headwinds on the back of economic support measures including the Targeted Economic Support Scheme (Tess) and government initiatives such as expansion of the Golden Visa programme.

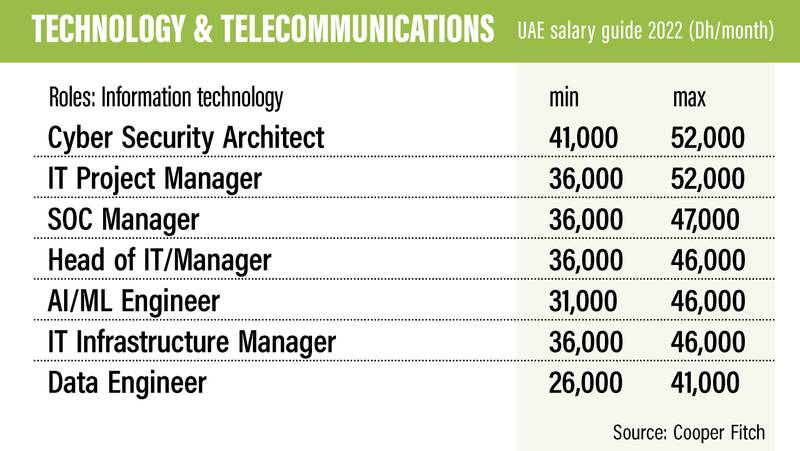

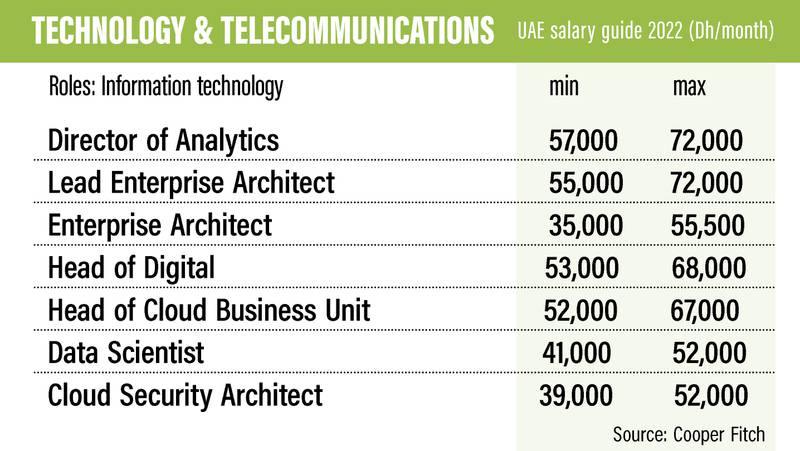

There is healthy demand for technology positions and roles in digital banking in the UAE as traditional lenders hasten the shift to online services, says Waleed Anwar, managing director of Dubai-based recruitment company Upfront HR.

“New digital banks also require a lot of tech talent. Roles in anti-money laundering, mergers and acquisitions are also trending,” Mr Anwar says.

Although the UAE’s banking industry faced challenges during the Covid-19 pandemic, many banking jobs will be created, especially for senior management roles, over the next few months, he says.

The UAE jobs market has made a strong recovery from the coronavirus-induced slowdown, helped by the government’s fiscal and monetary measures.

About 76 per cent of employers in the Arab world’s second-largest economy plan to expand their workforce in 2022, a survey in February by Bayt.com and YouGov found.

About two thirds of professionals in the UAE will actively look for new jobs this year as business confidence and hiring activity return to pre-pandemic levels, recruitment company Robert Walters said.

What positions are in demand?

There is continuous demand for relationship managers across all units of banks, such as consumer and retail, corporate and wholesale, and investment and private banking operations, says Mark Nancarrow, managing partner of Flow Talent, which sources professionals for banking and financial services.

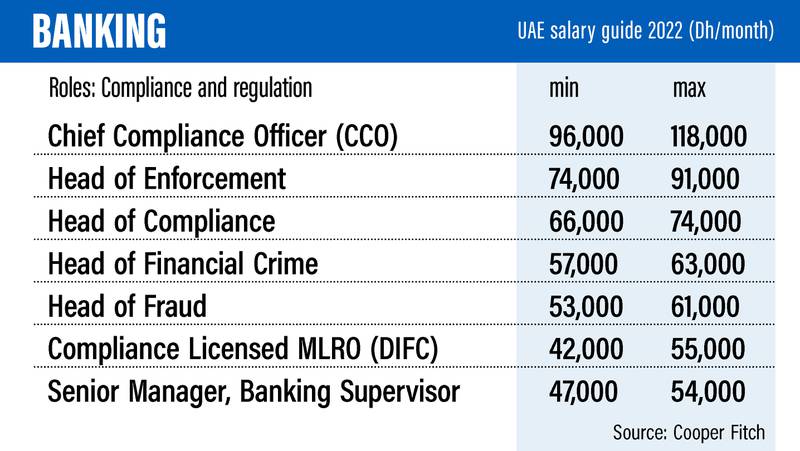

“With the continued introduction of new regulations by the Central Bank of the UAE, we are seeing a demand in consumer protection, regulatory, compliance and risk positions, too,” he says.

There is demand for commercial and revenue-generating roles in the banking sector, such as in loan sales, investment banking, wealth management, mortgages, equity, financial trading and similar services, Mr Anwar says.

“This is mainly driven by the need to capitalise on the ongoing recovery in the region post the pandemic. And due to digitalisation, we will continue to see demand for tech and digital roles,” Mr Anwar says.

Meanwhile, in the financial services market, there is a strong demand for experienced analysts, sales professionals at all levels and digital marketing candidates who are able to raise a company’s brand and communicate effectively to customers and investors, according to data from Flow Talent.

Candidates with experience in digital payments, digital platforms, fund and investment management, private equity and capital raising are also in major demand. Regional experience in the GCC is highly desired and sought-after, according to Mr Nancarrow.

“We also continue to see a steady request for shared service positions such as accountants, HR and talent acquisition managers,” he says.

The most sought-after positions in the UAE’s banking industry include the roles of investment associates, investment finance managers, institutional sales directors and associates, compliance managers, corporate development and investment managers and directors, and fund finance managers, according to recruitment consultancy Michael Page’s 2022 salary guide.

Since the end of 2021, banking and finance roles hired for “quite frequently” include asset, wealth and financial managers, blockchain developers, compliance and regulatory managers, credit analysts, credit approval managers, cyber-security analysts, data specialists and fraud prevention specialists, Flow Talent says.

What skills are employers looking for?

Financial modelling is a key skill employers are looking for in the banking industry, given changes in organisations’ capital structures (for example, restructuring or refinancing of debt) and an impetus in investment activity with cash-rich investment companies and groups willing to pick up well-priced assets, the Michael Page report says.

Another skill in demand among employers is financial control and commercial finance, the recruitment consultancy says.

“At the back of two challenging years, 2020 and 2021, organisations are keen to tighten financial controls and have professionals who are better able to manage and raise finances. Those who come with strong banking relationships are preferred,” according to the Michael Page salary guide.

Experience in institutional sales and fund-raising is also sought-after by UAE employers, the research shows.

With enhanced stability and mega-events closer to taking place in the region, investor sentiment is high across regional and global venture capital, property, private equity and equities — this has resulted in a year-on-year increase in fund-raising roles, Michael Page says.

Compliance also continues to be an area in high demand across the region, the consultancy says.

The main drivers for this demand include a number of new entities opening in key financial centres such as the Dubai International Financial Centre and the Abu Dhabi Global Market, as well as the constant evolution of compliance frameworks, controls and processes, it says.

“As such, employers are prioritising candidates with an excellent knowledge of local regulations [both the ADGM Financial Services Regulatory Authority and the Dubai Financial Services Authority],” Michael Page says.

“Additionally, as most organisations are constantly seeking to improve their compliance controls, frameworks and policies, any candidates who have explicit experience in leading projects of this nature will be at an advantage.”

Aside from industry experience and the required qualifications, employers also look for excellent communication skills, a commitment to learning, leadership and knowledge-sharing skills, self-motivation, a strong work ethic, attention to detail and organisational skills, Flow Talent’s Mr Nancarrow says.

Are salaries expected to rise in the banking and financial services sector?

There is definitely an expectation of higher salaries on the part of employees, which is mainly driven by the rising cost of living in the region, in general, Mr Anwar from Upfront HR says.

The pressure is on employers to raise salaries to retain staff and also attract the best talent to their organisations.

While there is no fixed salary increase across the banking and financial services industries, employers are very competitive with their offers to secure new employees, Mr Nancarrow says.

What other benefits can employees expect?

Employees in the banking and financial services industry are looking for a better work-life balance, flexibility, autonomy and career progression. Companies that offer these conditions and benefits will have the best staff and attract the best talent, Mr Anwar says.

Meanwhile, employees can also expect — and should request — more benefits, such as work-from-home days, training and the acquisition of additional skills, for example, in digital and technology, to be able to bridge the learning gap, he says.

About 95 per cent of businesses hiring now offer work-from-home and office balance and great bonuses, while family medical insurance and annual flights are always expected and offered, Mr Nancarrow says.

“Housing and education allowances are included for higher-level grades. However, there has been a shift and these benefits are not as forthcoming as they previously were in the region,” he says.

Do employers face hiring challenges?

A decreased influx of international talent over the past 18 months has resulted in a shortage of various specialised skills within the local market, according to the Michael Page salary report.

Organisations should remain open, where possible, to internationally based candidates who are open to relocating to the UAE, the consultancy says.

“They should also consider candidates with transferable skills who are based locally. Candidates should better present their technical skills, which are transferable, and demonstrate objective rationale for switching functions or industries,” it says.

However, the biggest challenge employers face in hiring and attracting the “right” talent is finding the balance between offering a competitive salary and benefits without disrupting current employees, Mr Nancarrow says.

There is also a shortage of talent with digital and technology skills and this is a major challenge for employers in the UAE, Mr Anwar says.

“There is a high demand for these professionals in all sectors. This is adding to the cost of hiring candidates who have these skills,” he says.

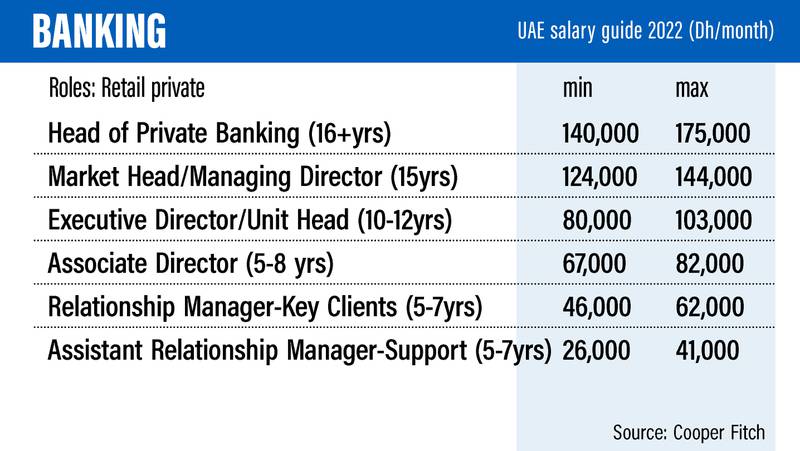

How much can you expect to be paid in the banking and financial services sector?

Wholesale banking

- Head of wholesale banking (executive vice president): Dh147,000 (a month)

- Head of corporate banking (senior vice president): Dh95,000

- Head of unit: Dh60,000

- Senior relationship manager: Dh40,000

- Relationship manager: Dh30,000

- Relationship officer/assistant relationship manager: Dh18,000

Retail banking

- Head of consumer banking (EVP): Dh157,000

- Head of retail banking (senior vice president): Dh97,000

- Head of assets/sales: Dh75,000

- Senior manager for products/sales: Dh60,000

- Manager for products/sales: Dh40,000

- Officer/assistant manager for products/sales: Dh20,000

Investment banking

- Managing director: Dh155,000

- Executive/senior director: Dh100,000

- Director: Dh80,000

- Vice president: Dh65,000

- Associate: Dh47,000

- Analyst: Dh25,000

Private equity/investments

- Managing director: Dh126,000

- Senior vice president/senior director: Dh111,000

- Vice president/director: Dh78,000

- Senior associate: Dh53,000

- Associate: Dh47,000

- Analyst: Dh25,000

Risk

- Chief risk officer: Dh95,000

- Head of risk: Dh67,000

- Manager: Dh35,000

- Senior analyst: Dh27,000

- Analyst: Dh18,000

Compliance

- Head of compliance/chief and Money Laundering Reporting Officer (MLRO): Dh65,000

- Vice president of compliance, MLRO: Dh35,000

- Compliance manager: Dh30,000

- Compliance associate: Dh26,000

- Analyst — Anti-money laundering/fraud/regulatory/compliance: Dh17,000

Insurance

- Managing director: Dh97,000

- Senior vice president/senior director: Dh60,000

- Vice president/director: Dh45,000

- Senior associate: Dh28,000

Operations

- Chief operating officer: Dh82,000

- Head of operations: Dh60,000

- Assistant manager/manager: Dh35,000

- Officer/analyst: Dh27,000